(MartinArmstrong) “Politicians everywhere are sitting on their hands because they believe that if they do nothing and maintain the status quo mixed with austerity to save the bankers somehow we will grow our way out of this one as before. The problem is they fail to distinguish between a private generated financial crisis and a Sovereign Debt Crisis where they are the problem.

The people are just not to be given a right to vote on any of this and if the system can grow out of it, in two years everyone will forget about it – that’s the plan. To clarify why I have been critical of the austerity in Greece and the property taxes, Schumpeter describes the Business Cycle as a force of Creative Destruction. These are periods of tremendous economic transition. It is one thing to impose property taxes and insist upon government reducing its work force that sound like solid conservative economic advice for Greece. However, that presumes there are private sector jobs waiting in the wings. What is taking place in Greece is that there is no private sector alternatives at this time. Laying people off is one thing. To impose then property taxes that are due irrespective of income then subjects those same people to massive waves of foreclosures for failure to pay the tax. The US Great Depression was so bad NOT because of the stock market crash, but (1) the sovereign debt crisis that wiped out savings and reduced capital in the USA contributing to over 3000 bank failures, and (2) the Dust Bowl that eliminated agrarian jobs when agriculture accounted for 40% of the civil work force resulting in the ‘hobo’ lifestyle. It was WWII that provided the ‘transition’ reducing unemployment and transformed farmers into skilled labor. The Great Depression after the Panic of 1857 was followed 4 years later by the US Civil War, which was also the ‘transition’ at that time relieving unemployment.

Today, there is no plan. There is no transition, only austerity. The politicians are doing NOTHING whatsoever for any reforms they reject because it would change the way they have been doing business since WWII. Italy’s debt is bigger than Spain, Portugal, and Greece combined. It is too big to be bailed out and there is no PLAN B to even address what happens if sitting on their hands blows up in everyone’s face? Stay away from ALL government debt! This is a wave of Creative Destruction. We are in a transition to a completely new world ahead.”

Full Story: Italian Head of State Pledges to Resign Schumpeter’s Creative Destruction? (MartinArmstrong)

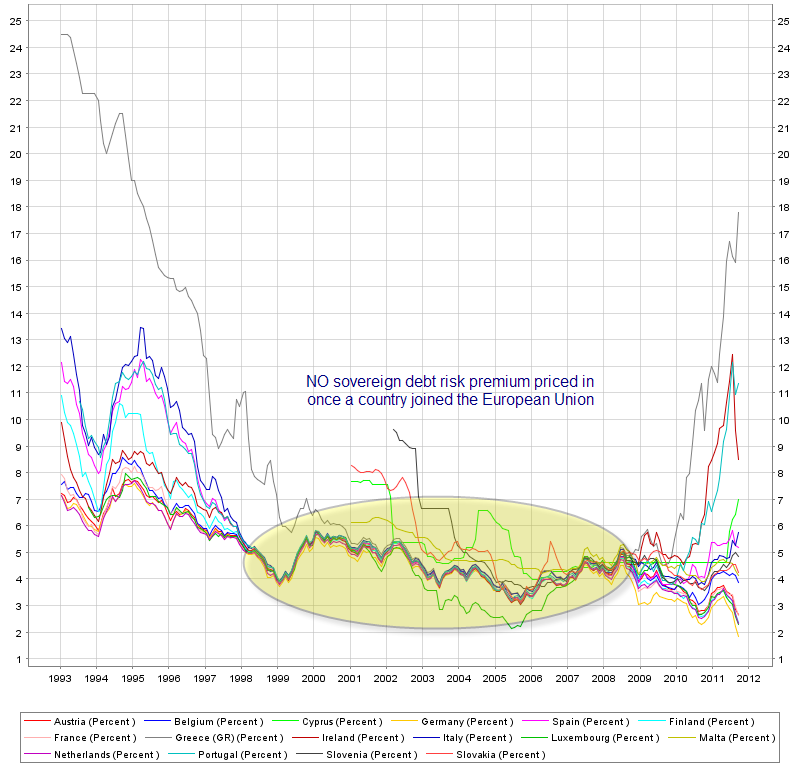

(MartinArmstrong) “Government Is Living in a State of Denial. They speak, see & hear nothing of a debt crisis. .. Italy is the third largest bond issuer and nobody in government has figured out that this a Sovereign Debt Crisis yet? What Government FAILS to understand is they are the PROBLEM!

Because government is the PROBLEM, they live in a state of denial and cannot correct the situation for they cannot objectively look at themselves. Instead, they attack the people. Fannie Mae asks for $7.8bn as losses continue. Morgan Stanley has been accused over mortgage bond issues and MF Global goes bust exposing the truth that SEC & CFTC never audit the NY banks and are incapable of detecting that they may be trading with client’s money.

.. the whole theory upon which the banking system has been constructed is unsound. Banks take short-term and demand deposits and lend long-term. When a financial crisis unfolds, a run on banks emerges because people want their money. Since the bank’s obligations are short-term to demand but their assets are loans of medium to long-term, they don’t have the cash and fail. For you see, banks were not supposed to lend out your money. .. Banks began as merely a place to store your assets. They were not intended to lend your money out to someone else. When they realized they could make profit doing so, the scam eventually became the standard operational procedure. Formulae were then devised to calculate at any one time how much ‘reserves’ did they have to retain for normal operations. That was worked out with experience settling on 6%. So if they retained 6% of deposits as cash, they could cover normal business withdrawals with no problem. The problem became during a crisis and everyone wanted their cash and the bank simply does not have that cash and you end up with a bank run. It is ironic that what began as a scam simply became institutionalized. This is WHY the entire financial system is dependent upon CONFIDENCE!

What is unraveling even more quickly is the fear that banks will be hit with panic runs because of their holdings in sovereign debt. After a 50% haircut in Greek bonds, now it has become trendy not only to sell Italian bonds but also to publicly announce they have done so to try to maintain CONFIDENCE of their depositors. The very reason politicians have suppressed the right of the people to vote and have forced austerity upon the people, has been to maintain the confidence of their bankers. But in the end game, the bankers exist based upon the confidence of the people in their sound management of their deposits.

.. The people may be shut out of the polls denied democracy when it is needed most, but the FREE MARKETS will respond as capital votes in its own self-interest that does not match the political nonsense.

SEQUENCE OF AN ECONOMIC PANDEMIC

At first blush, how capital responds depends entirely upon the (1) monetary system and (2) the freedom of capital movement. In a closed economy, the first reaction is to buy ALL tangible assets. These tend to be everything from durable commodities (metals), art, coins, stamps, and gold (assuming it is not a gold standard of some sort). This is the category I refer to as ‘moveable assets’. The second tier of assets tend to be real estate that I refer to as ‘fixed non-movable assets’ meaning their value is limited to the territorial jurisdiction of the nation. In a non-communist nation, stocks and corporate bonds will also attract capital as a safe place to park funds. In an open-economy where capital is free to leave, then the first blush is to FLEE to a different land in which case the local assets, including stocks and corporate bonds, will initially crash. This is typically indicated most pronouncedly in the collapse of the local currency against world currencies or in this case rise in the dollar vs decline in euro. They eventually swing back ONLY after the crisis manifests in a new currency or a debased/devaluation of the local currency takes place. The capital-flows will the swing back in the opposite direction.

Under today’s circumstances, the first blush response will be for capital to flee Europe and run to the United States as a safe port parking in US government paper. This is likely to further the deflationary effects within the United States by ensuring interest rates remain low as they did during the Great Depression for the same reason. However, banks are living off of the largest spreads perhaps in modern history so while rates of interest on cash will decline further and move in real terms NEGATIVE after inflation, banks should NOT be expected to lend money more easily. They will maintain their huge profit margins. Therefore, the first blush of the Sovereign Debt Crisis in an open society tends to be currency based rather than even movable assets.

During the inflationary boom into 1929, gold declined in purchasing power for assets were rising against gold. During the collapse, the value of money rose (gold) as assets declined. Under a gold standard, the value of gold in fact DECLINES with inflation and RISES with deflation.

So for now, we are in the first blush mode where capital will fee to the dollar rather than assets and that may confuse the hell out of a lot of people. Therefore, under the current conditions, gold need not rise on the first blush for the bulk of capital will flee to the dollar. On the second swing where capital flees all currency, then we will see the Private vs Public assets manifest meaning they will rise as expressed in terms of currency.”

Full Story: Government is Living in a State of Debt Denial (MartinArmstrong)

Click for Nov 11, 2011 Martin Armstrong Radio Interview (FSN)

RSS feed for comments on this post.

RSS feed for comments on this post.