This awesome and quick video explains quantitative easing in a simple and easy way for everyone to understand, and it’ll keep you laughing (or crying) the whole way through…

One note, granted this video hits heavily on Ben Bernanke, it’s certainly not all his fault – not by a long shot. Living beyond our means can only go on so far, and politicians are more than happy to take advantage of public sentiment to fulfill their own agendas and help their “friends” through gargantuan spending programs and greater controls enacted under the guise of serving the “greater good”.

“Quantitative Easing Explained” Transcript:

#1: Did you hear about the Fed?

#2: No, what about the Fed?

#1: They announced another round of the quantitative easing.

#2: What does that mean?

#1: It means they are going to make large asset purchases via POMO [Permanent Open Market Operations].

#2: What does that mean?

#1: It means they are going to expand their balance sheet and buy treasuries.

#2: What does that mean?

#1: It means they are going to print a ton of money.

#2: So why do they call it the quantitative easing? Why don’t they just call it the printing money?

#1: Because the printing money is the last refuge of failed economic empires and banana republics, and the Fed doesn’t want to admit that this is their only idea.

#2: So why do they want to print the money?

#1: Because they say we have the deflation and the deflation is very bad.

#2: What is the deflation?

#1: The deflation is when prices of the things we buy go down.

#2: Isn’t that good? Doesn’t it mean the people can buy more of the stuff?

#1: Yes, but the Fed says this is bad, especially during the recession.

#2: So they think that during the recession, when the people have less money to buy the stuff, it is bad that the prices go down?

#1: Yes, the Fed would rather have the deflation.

#2: So why does the Fed think we have the deflation?

#1: Because the CPI said so.

#2: But aren’t the food prices higher than a year ago?

#1: Yes

#2: Aren’t the gas prices higher than a year ago?

#1: Yes

#2: Aren’t the healthcare costs higher than a year ago?

#1: Yes

#2: Aren’t tuition prices higher than a year ago?

#1: Yes

#2: Aren’t the taxes higher than a year ago?

#1: Yes

#2: Aren’t the subway fares higher than a year ago?

#1: Yes

#2: Aren’t the stock prices higher than a year ago?

#1: Yes

#2: Aren’t the bond prices higher than a year ago?

#1: Yes

#2: So what is deflating right now?

#1: The only thing deflating that I can see is the Fed’s credibility.

#2: Did they have a lot of credibility to start with?

#1: No

#2: Why not?

#1: Because the Fed has been wrong about every major economic development in the past 20 years.

#2: You mean they didn’t see the internet stock bubble?

#1: No, in fact they helped fuel the internet stock bubble.

#2: And they didn’t see the housing bubble?

#1: No, in fact they helped cause the housing bubble.

#2: And they didn’t see the subprime crisis?

#1: No, in fact they told us subprime problems were contained right before the shit hit the fan and the Lehman went bankrupt.

#2: So has the Fed ever been right about anything?

#1: Let me see if I can think of anything? No, nothing.

#2: Who runs the Fed?

#2: the Fed is run by the Ben Bernanke.

#1: Does the Ben Bernanke have a lot of business experience?

#2: No, the Ben Bernanke has no business experience.

#1: Does the Ben Bernanke have a lot of policy experience?

#2: No, the Ben Bernanke has no policy experience.

#1: Has the Ben Bernanke ever run in an election?

#2: No, the Ben Bernanke has never run in an election.

#1: I don’t know. Maybe the fact that he has a nice beard.

#2: But my plumber also has a nice beard, and I would not trust him to play god with the economy.

#1: No, although when you call the plumber to fix something that is broken, they usually fix it, not break it more.

#2: This is true, the plumber is clearly smarter than the Ben Bernanke.

#1: Well, that is why he became a plumber and not an economist.

#2: How does the Fed execute the quantitative easing?

#1: They print the money, and then they buy the treasury bonds.

#2: Do they buy the treasury bonds from the treasury department?

#1: No, they buy the treasury bonds from the Goldman Sachs.

#2: You must be shitting me.

#1: No

#2: So let me get this straight. If I want to buy the treasury bonds with my money, I can buy them directly from the treasury.

#1: Yes

#2: And if you want to buy the treasury bonds with your money, you can buy them from the treasury.

#1: Right

#2: But if the Ben Bernanke wants to buy the treasury bonds using the American people’s money, he does not buy them from the treasury? He buys them from the Goldman Sachs?

#1: Exactly

#2: But does the Goldman Sachs give them a good price?

#1: Of course not. They are the Goldman Sachs. They make their living ripping off the American people.

#2: But how is the Goldman Sachs able to do this?

#1: the Fed announces what it is going to buy and when it is going to buy before it does the trade.

#2: So the Goldman Sachs can front-run the Fed and give them the worst possible price on the treasury bonds?

#1: Yes, exactly.

#2: And the Fed is okay with blatant theft from the American people?

#1: Of course, otherwise the Fed would just buy the treasury bonds directly from the treasury department.

#2: Who inside the Fed is responsible for buying the treasury bonds?

#1: The buying of the treasury bonds is conducted by the New York branch of the Federal reserve.

#2: And who is in charge of the New York branch?

#1: The head of the New York branch is the William Dudley.

#2: And what did the William Dudley do before running the New York fed?

#1: Before running the New York fed, the William Dudley was a partner at the Goldman Sachs.

#2: So the guy in charge of the American people’s money when dealing with the Goldman Sachs used to be a partner at the Goldman Sachs?

#1: Yes

#2: And nobody has a problem with this?

#1: Apparently not.

#2: Is this an episode of the twilight zone?

#1: I don’t think so.

#2: Are you sure?

#1: Pretty sure.

#2: So what you are telling me is that the Fed thinks prices are going down when in fact they are going up?

#1: Yep.

#2: And they think during the recession, with the high unemployment, it is better if the things people need to buy cost more money?

#1: Correct, according to the Ben Bernanke, the inflation will create the jobs and improve the housing market.

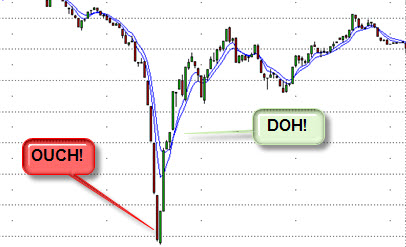

#2: Has this ever been tried before?

#1: Yes, just last year the Fed tried the quantitative easing with 2 trillion dollars.

#2: Did that create the jobs?

#1: No

#2: Did it help the housing market?

#1: Not at all.

#2: Did it help anybody at all?

#1: Yes, it helped the Goldman Sachs.

#2: How much of the money are they printing now?

#1: 600 billion dollars.

#2: So even though the first 2 trillion did not create the jobs, or improve the housing market, the Fed decided to do another 600 billion anyway?

#1: Yes

#2: Who put the Ben Bernanke in charge?

#1: The Ben Bernanke was first appointed by the President Bush, then he was reappointed by the President Obama?

#2: But wasn’t the President Obama supposed to bring the change?

#1: Yes

#2: How is putting in charge the same fool, who has been wrong about everything, the change?

#1: Well, under the President Bush the Ben Bernanke only blew up the American economy. Under the President Obama, he is working on blowing up the entire global economy.

#2: That does not sound like the change we can believe in.

#1: Definitely not.

#2: Who else supports the Ben Bernanke?

#1: Most economists around the world think the quantitative easing is very dangerous.

#2: Does anyone think it is a good idea?

#1: Yes, the people at the Goldman Sachs.

#2: Is this some sort of nightmare?

#1: No, it is very real.

#2: I want to bang my head against the wall.

#1: You should not do that.

#2: Why not?

#1: Because the healthcare is too expensive.

#2: But didn’t the President Obama fix that?

#1: No, but that is the subject of a whole other video. Goodbye…

1 Comment »

RSS feed for comments on this post. TrackBack URL

RSS feed for comments on this post. TrackBack URL

THANK YOU! I’ve seen the video a dozen times and couldn’t figure out the “via POMO” part, so I googled the rest of that comment and landed here.