Apparently it’s possible to extrapolate the current rate of the M3 money supply figures pretty accurately after all, even after the Fed decided to “de-emphasize” its role. Let’s see what the current rates would have been expected to be, and what they suggest for the economy and the stock market… I also discuss the credit cycle and the effects of easy credit and leverage on the transfer of wealth.

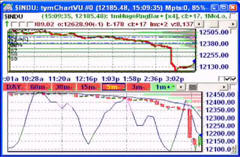

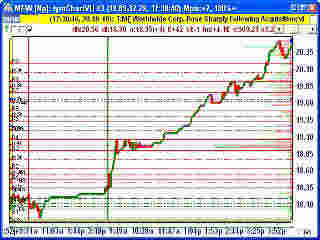

I had mentioned that I could only imagine what would happen after the figures were no longer published. As it turns out, while the Fed may have been able to partially “de-emphasize” its role, it has still been possible to extrapolate it quite accurately into the future using other available data, and the figures are quite staggering. Any wonder why the stock market has been the rising so strongly as of late, exceeding so many investors’ expectations? All that newly printed money’s gotta end up somewhere, and I don’t think it’s going into real-estate anymore. Just wait for my episode on that topic. (NOTE: Check out the “Housing Bubble” Link in the Links Section, whose content seems to reflect my opinions on the subject quite accurately).

Now just to clarify, this does not mean that stocks can go straight to the moon either. That depends on how many investors are bullish on heavy leverage. It’s the leverage that causes the real big swings in both directions, and while we may know, for example that average real-estate prices will eventually go still higher than their last current peaks, that doesn’t mean that prices won’t first fall back just far enough to take out the all the neaveau-riche heavily leveraged real-estate entrepreneurs that have come into the game to stake out quick fortunes. It’s great going up, but try dumping an illiquid investment on the way down. Just look what happened to Gold earlier this year… and that’s a LIQUID investment. When the bank come’s a knocking, someone’s gonna have to pay the piper. And that’ll be when the real money will be made by the truly wealthy, probably paid for with their hordes of stored cash, ready to wait out the next big real-estate frenzy that inevitably cyles through.

Going back to the original topic of M3, the projected figures indicate that M3 has been growing at approximately an 11% year over year annual rate of change. If you go by the pre-Clinton era CPI figures, we’re still showing inflation running at a 5% annual rate, and if you use an alternate measure available from the shadowstats.com links in the transcript section of this vlog episode, you’ll notice that the true rate of inflation could be in fact be as high as 9% with all factors considered.

Whichever figures you choose to believe, it makes for some seriously interesting thought… Well, we’ll be needing something to pump us out of the coming recession. So how about just pumping out even mo money to get things going again! Gotta be there and ready to catch the next even bigger upwave in asset prices once all the weak hands are forced out and left for broke…

2 Comments »

RSS feed for comments on this post. TrackBack URL

RSS feed for comments on this post. TrackBack URL

this is one of the best episodes yet…..yes.. the real estate market has crashed, and i’m one of the over leveraged tycoon… but we share the same belief..real estate will move up, beyond the peak that we saw in mid 2005……it’s only a matter of time as the M3 money heads back this way after the weak hands fall out..

Just ran across several of your episodes, Alexander, and you really seem to have an honest grasp of the pitiful shape our economy is in….especially loved your talk about oil prices, which is my field.

Thanks, keep spreading the REAL word about what’s going on!!!

Jeff